(May 2025)

Outline of Medium-Term Management Plan

1. Review of the FY2024 Medium-Term Management Plan

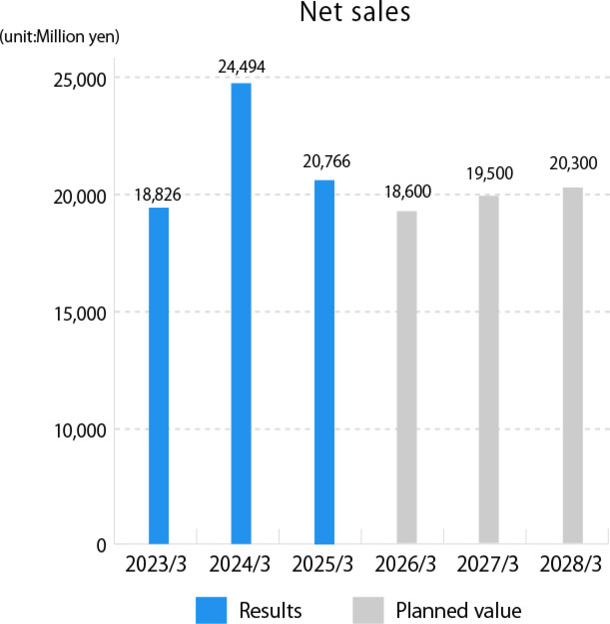

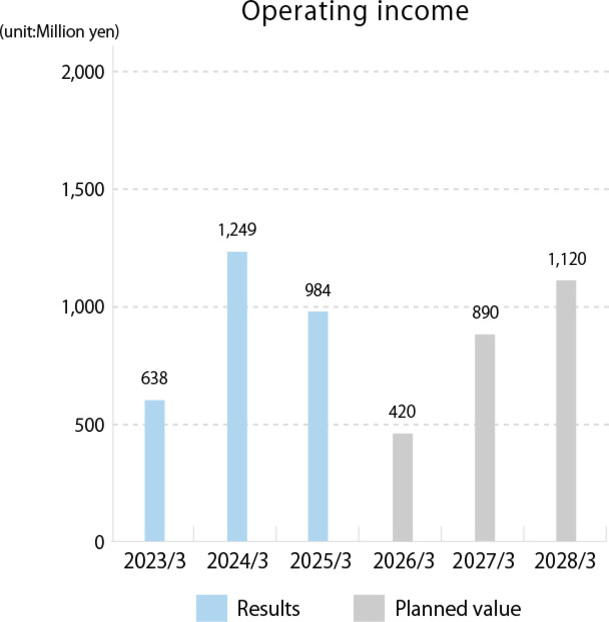

Plan for the fiscal year ending March 2025

| Million yen | Sales ratio | |

|---|---|---|

| Sales | 22,100 | 100.0% |

| Operating Profit | 650 | 2.9% |

| Ordinary profit | 660 | 3.0% |

| (Parent)Net income | 400 | 1.8% |

Results for the fiscal year ending March 2025

| Million yen | Sales ratio | |

|---|---|---|

| Sales | 20,766 million yen | 100.0% |

| Operating Profit | 984 million yen | 4.7% |

| Ordinary profit | 1,033 million yen | 5.0% |

| (Parent)Net income | 576 million yen | 2.8% |

The global economy has been showing signs of stability due to the calming of high inflation in Europe and the United States, but the outlook remains uncertain due to the slowdown in the Chinese economy and rising geopolitical risks such as prolonged conflicts in various regions. In particular, since the inauguration of the new US president, the global economy has been at the mercy of his movements, increasing uncertainty. Against this backdrop, there has been a trend to refrain from capital investment, and consolidated sales for fiscal year 2024 were 20,766 million yen, a decrease of 1,334 million yen from the planned 22,100 million yen.

In the Japan segment, there were no signs of a recovery in orders for injection molding machines and new orders struggled. However, orders received up until the previous year were sold as planned, resulting in sales of 14,166 million yen, an increase of 91 million yen over the planned figure of 14,075 million yen.

In the East Asia segment, in addition to the slowdown in the Chinese economy, capital investment in LIB-related equipment for Japanese electric vehicles (EVs) and smartphone and VR lens-related equipment fell sharply, resulting in sales of 1,187 million yen less than the planned 6,474 million yen, to 5,287 million yen.

In the Southeast Asia segment, sales fell 121 million yen to 2,268 million yen compared to the planned 2,389 million yen due to a slowdown in capital investment by Japanese companies in the region, which are struggling with the increased exports and active transfer of production by Chinese companies.

In the North and Central America segment, caution was shown towards new capital investment due to concerns over the actions of the new U.S. administration, but there was demand for the renewal of aging equipment, and although sales did not reach the plan, they were 34 million yen lower at 357 million yen compared to the planned 392 million yen.

Regarding profit and loss, although there was a decrease in sales and an increase in selling, general and administrative expenses, the gross profit margin improved due to the optimization of sales prices and improved production efficiency, so operating profit increased 334 million yen to 984 million yen, compared to the planned figure of 650 million yen, ordinary profit increased 373 million yen to 1,033 million yen, compared to the planned figure of 660 million yen, and net profit attributable to the parent company increased 176 million yen to 576 million yen, compared to the planned figure of 400 million yen.

2. Review of FY2024 management strategy

(1) Strengthen business expansion in new markets and growth fields

- Develop applications for industries other than plastics and secure and develop human resources

- Participate in cross-industry exhibitions to promote products and solutions and strengthen relationships with key customers

- Utilizing the Kawata Technical Center, we will respond to test requests from potential customers, accumulate know-how, and begin activities to develop applications.

- Develop and expand new sales fields such as batteries, food, cosmetics, and chemicals

- Exhibited at the International Powder Industry Exhibition, Food Processing Technology Exhibition, FOOMA JAPAN, and Cosmetics Manufacturing Technology Matching Fair

- Joined the Japan Food Machinery Manufacturers Association

- Initiatives for the EV-related industry

- Exhibited at BATTERY JAPAN, Japan Die Casting Exhibition, and INTERMOLD Nagoya

- Promoting commercialization of fine particle coating technology in preparation for practical use of all-solid-state batteries, with an increase in inquiries and test requests, mainly from the automotive industry

(2)Expand sales and improve profitability in existing markets and business fields

- Expand sales of standard machines by differentiating them through space-saving, labor-saving, and energy-saving features, and by strengthening our service capabilities

- An Indonesian manufacturing company developed chillers for Southeast Asia and began selling them in Indonesia first.

- Strengthening after-sales service through regular follow-up after delivery of major equipment

- Creating proposal materials and data to promote the benefits of our products

- Creating video content such as product introductions and maintenance methods

- Enhancement of sales promotion materials such as catalogs and test data

- Promoting efforts in system projects, including in the extrusion molding field

- Cost reduction through comparative quotations

(3) Strengthen management bases

- In order to strengthen compliance management, we have revised the internal reporting regulations and thoroughly informed all employees of them along with Group Activity Guidelines

- Construction and relocation of a subsidiary's Head Office factory for the purpose of responding to BCP (disaster risk) and business expansion (productivity improvement, research and development, remodeling and improvement)

(4) Promoting management that focuses on capital profitability

- Improving profitability

- Improve profitability through optimizing sales prices and improving production efficiency

- Enhancing asset efficiency

- Reduce interest-bearing debt by reducing working capital such as accounts receivable and inventory, and by making effective use of intra-group funds through the implementation of inter-subsidiary loans and reviewing intra-group dividends.

3. Business Environment and Basic Principles

(1) Business Environment

- While the economy is showing signs of resilience thanks to the calming of high inflation in Europe and the United States, there are also concerns over intensifying trade friction, and the IMF predicts that global real GDP growth will be lackluster and slow, at 2.8% in 2025, 3.0% in 2026, and 3.2% in 2027.

- In addition, the Chinese market has been in a prolonged slump, and as Chinese companies are increasingly expanding outside of China, Japanese companies are less willing to make capital investments, especially in the Southeast Asian market, resulting in sluggish demand. On the other hand, interest in the Indian market is growing, and investment in India is on the rise.

- Although the current situation is not good, there are hopes for labor-saving and energy-saving initiatives to compensate for the decline in the working-age population, particularly in developed countries, as well as demand for replacement of aging production facilities, and it is believed that equipment sales and services will recover in the medium to long term.

(2) Basic Principles

- Even from the medium-and long-term point of view, since plastic will remain an indispensable material in the lives of people around the world, demand is expected to grow in various fields.

- Since the automobile and electronic components industries have broad economic bases and present high growth potentials, we will continuously target them as our main areas. Specifically, we actively allocate our technologies and resources into the electrification of vehicles, autonomous, vehicle weight reduction, and integral molding (giga casting).

- We will effectively respond to the expanding use of communication devices (tablets, PCs, smartphones, and VR) that accompany social changes, while also supporting advances in digitization featuring AI, IoT, and 5G.

- To address environmental issues at the global level (decarbonization and reduction of disposable plastics), we aim to contribute to society in our customer’s production sites and our business activities as well as through their products. In particular, we believe that the fields of energy conservation, bioplastics, and recycling can be business opportunities for us.

4. Medium-Term Management Plan for FY2025-2027

(1) Medium-Term Management Policy

- Aim to be a “top-tier company” needed by society -

“To organize stronger business entity”

①Strengthen ESG management practices

- Contribution to environment and society

- Establishing highly transparent corporate governance

- Consideration for all stakeholders

(shareholders, employees, customers, suppliers, financial institutions, national and local governments, and local communities)

② Establish a highly profitable structure with a small number of highly-talented employees (For steady and sustainable growth)

- Investment in human capital (securing human resources, and establishing and operating education system)

- Investment in R&D and technological enhancement

- Optimum location and renewal of business offices, and investment in capacity enhancement and improved efficiency

- Promotion of automation, labor savings, and systematization

- Increasing capital efficiency (appropriate inventory management and reduction of interest-bearing debt)

- Stably maintain current profit of 1 billion yen or more and return on equity (ROE) of 8% or more

- Maintain a consolidated dividend payout ratio of 30% or more and a dividend on equity (DOE) of 2% or more

(2) Outline of Medium-Term Management Strategy

①Strengthen business expansion in new markets and growth fields (Initiatives to meet expanding customer needs and growth fields)

- By applying the technology and know-how cultivated in the plastic molding-related field, we will develop and expand new sales fields such as batteries, food, cosmetics, chemicals, etc. We will focus particularly on the "mixing process" and propose either a high-speed Mixing alone or a "Conveying and weighing process" that includes the process before and after the mixer as a system.

- We develop specific uses, and secure and develop human resources for the industries (food and new materials) other than the plastic industry, centered on high-speed mixers.

- New commitment to the EV-related industry

- LIB-related business (powder and film: material conveying and feeding, temperature control)

- Overseas market research on integral molding (Gigacast)

- Promoting commercialization of particulate coating technology to make all-solid-state batteries practical

- Responding to increasingly sophisticated optical lens market demands

- Research aimed at strengthening business in the Indian market

②Expand sales and improve profitability in existing markets and fields (Initiatives to retain customers and expand our market in existing markets and fields)

- The goal is to expand sales of standard machines (Conveying Machine, Blender, high-speed Mixing, Dryer, Heating Medium Circulation Temperature Controller, chillers, and plastic Granulator).

- We will differentiate ourselves by developing new models with excellent operability to achieve space-saving, energy-saving, and environmental improvement, improving and refining existing models, appealing to customers with easy-to-understand proposal materials, mutually complementing products and parts from domestic and overseas group companies, and strengthening our service response capabilities, thereby attracting disadvantaged customers and sleeping customers and promoting a brand change from competitors.

- We aim to increase sales and profit, actively supporting system projects for fields including extrusion molding

- We capture the demand for replacement purchases by users, as well as respond properly to investment in labor saving and production efficiency as the working-age population has decreased particularly in the developed countries.

③Enhance management foundation (Initiatives to enhance management foundation for sustainability growth)

- Establishing highly transparent corporate governance

- Practicing honest corporate activities based on thorough compliance awareness

- Strengthening and promoting risk management and BCP

- Promoting human capital management

- Securing excellent human resources and appropriate personnel

- Ensuring psychological safety

- Enhancing education and training systems based on development policies

- Strengthening diversity initiatives

- Creating synergy effect of the Group

- Optimization and reorganization of business bases

- Strengthening mutual collaboration among the Group companies

- Implementing global human resources development program and enhancing personnel exchanges among the Group companies

- Reviewing operations and updating systems to standardize work and promote efficiency

- Actively disseminating information to increase awareness of our business activities and lead to business growth (exhibitions, websites, IR activities, etc.)

4) Promote management that is conscious of capital profitability (promote improvements in capital profitability from both the perspectives of profitability and asset efficiency)

- Improving profitability

- Accelerating mid-term business strategy initiatives to bring profit improvement forward

- Improving profitability of existing businesses by focusing on adding value and developing new, highly profitable businesses

- Considering reforms to the business operations of overseas subsidiaries to stabilize profits

- Enhancing asset efficiency

- Reduction of current working capital (early collection of accounts receivable, expansion of advance payment transactions for large projects, optimization of inventory, and shortening of production lead times)

- Effective use of funds within the group

(3) Mid-term management targets for fiscal 2025

FY2025 Mid-term Management Targets

| FY ending March 31, 2026 | FY ending March 31, 2027 | Fiscal year ending March 2028 | ||||

| Million yen | Sales ratio | Million yen | Sales ratio | Million yen | Sales ratio | |

|---|---|---|---|---|---|---|

| Sales | 18,600 million yen | 100.0% | 19,500 million yen | 100.0% | 20,300 million yen | 100.0% |

| Operating Profit | 420 million yen | 2.3% | 890 million yen | 4.6% | 1,120 million yen | 5.5% |

| Ordinary profit | 410 million yen | 2.2% | 900 million yen | 4.6% | 1,130 million yen | 5.6% |

| (Parent)Net income | 190 million yen | 1.0% | 590 million yen | 3.0% | 770 million yen | 3.8% |

Sales and profit targets (as of May 2025)